Tremors in Japan will unleash a global financial tsunami

Key Markets report for Tuesday, 18 November 2025

Today, Japan’s 20‑year government bond yield surged to 2.75%, that’s the highest level on record, marking perhaps the final unravelling of a three-decade interval that underpinned global retirement savings. Ten-year government bonds blasted through 1.7%! This is Japan’s slow-motion unravelling. The nation’s debt stands at over 260% of GDP, totaling $10.2 trillion. This may have seemed sustainable thanks to ZIRP (zero interest rates policy), but this has changed very radically:

With interest at or near zero percent, it seemed that massive amounts of debt could be stacked up, seemingly consequence-free. But at today’s yields, debt service costs will soar from $162 billion to $280 billion over the next decade. Fully 38% of government tax receipts will be spent just on interest payments to the bondholders.

This level of debt burden is beyond unsustainable and it will force Japan to either default or inflate away its debt (still a form of default). As Japan’s monetary and fiscal authorities cope with this gathering crisis, the consequences will be felt worldwide. For starters, Japan owns some $3.2 trillion in foreign assets. Of that amount, $1.13 trillion is allocated to U.S. Treasuries.

Japan’s large foreign investments were partly driven by ultra-low interest rates at home, but now that Japanese 20-year government bonds pay 2.75%, much of that capital will begin to flow back home. Some analysts expect as much as $500 billion in capital to flow back to Japan over the next 18 months.

Furthermore, Japan’s long standing low interest rates policy has given rise to the yen carry trade, whereby the global shadow banking system raised capital in Japan at low or no cost, and invested it abroad for higher yields. Yen carry trade is worth around $1.2 trillion and it’s helped inflate the global everything bubble including stocks, bonds, real estate and crypto markets. Raising Japanese rates could force liquidations across the board, triggering an avalanche of unforeseeable proportions and consequences.

The next Monetary Policy Meeting at the Bank of Japan will take place in a month’s time (18 and 19 Dec. 2025). At present, analysts believe there’s a 50% chance they’ll hike interest rates once more. That estimate perfectly matches my own sophisticated calculation (either they’ll hike or they won’t, making it exactly a 50% probability). If so, the yield gap between the U.S. and Japanese bonds will narrow further.

During the last six months, it has already narrowed from 3.5% to 2.4%. As it approaches 2%, capital flows back to Japan will accelerate which could push U.S. borrowing costs up by 30–50 basis points. Yen could surge and the carry trade reversal will gather pace, triggering margin calls across the world.

Things were discernible long ago…

Way back in March of 2010 I published an article titled, “Japan: the Harbinger of (bad) things to come,” opening with the sentence, “Large and gathering imbalances brewing in the Japanese economy threaten to generate a tsunami-like fallout that could soak most of the global economy.”

At that time it would have been impossible to predict the current circumstances, but even back then it was clear that the policy makers took a wrong turn. In 2010, Japan was well into its 10th year of Quantitative Easing (QE), shoveling money from BOJ printing presses at every economic problem. Ever since then, QE has been the central bank’s solution to pretty much every problem.

Kicking the can down the road fixed nothing and the crisis only worsened since then. After several rounds of ever bigger all-that-it-takes QE programs and stimulus measures, in February 2022, the BOJ had to pull out all the stops and resort to QE infinity, buying unlimited amounts of Japanese Government Bonds.

At the time, they capped the interest yield at 0.25% to avoid inflating the domestic borrowing costs, but if you conjure unlimited amounts of credit from thin air to finance government’s runaway deficit spending and you keep the interest rates suppressed below market levels, you are certain to blow up the currency.

Some form of unravelling is unavoidable: the BOJ can only choose between a debt crisis and a currency crisis.

What happens next

Four years ago, I made the following specific prediction about the unravelling of the Japanese crisis:

We’ll see a period of stagflation (inflation + recession). the inflation part could ultimately morph into a hyperinflation;

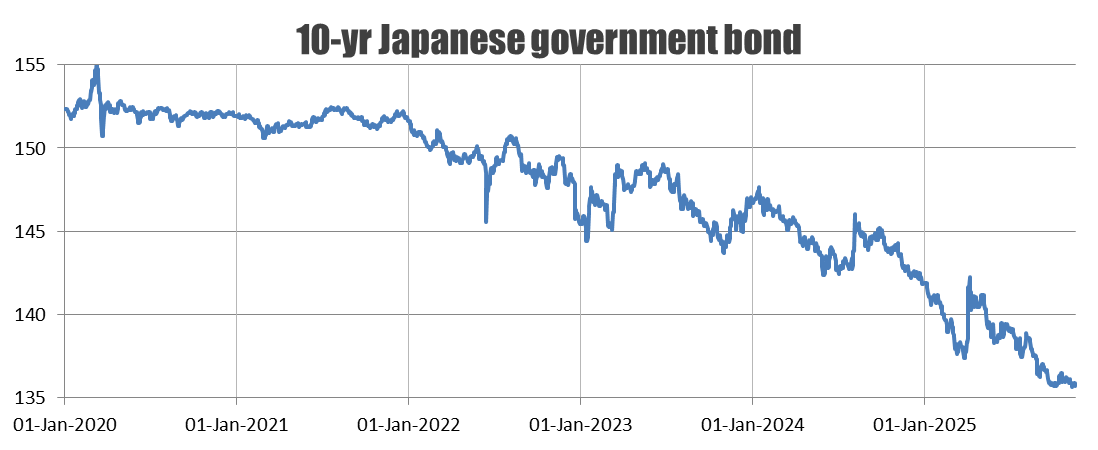

Interest rates will continue to rise and the price of Japanese Government Bonds will collapse.

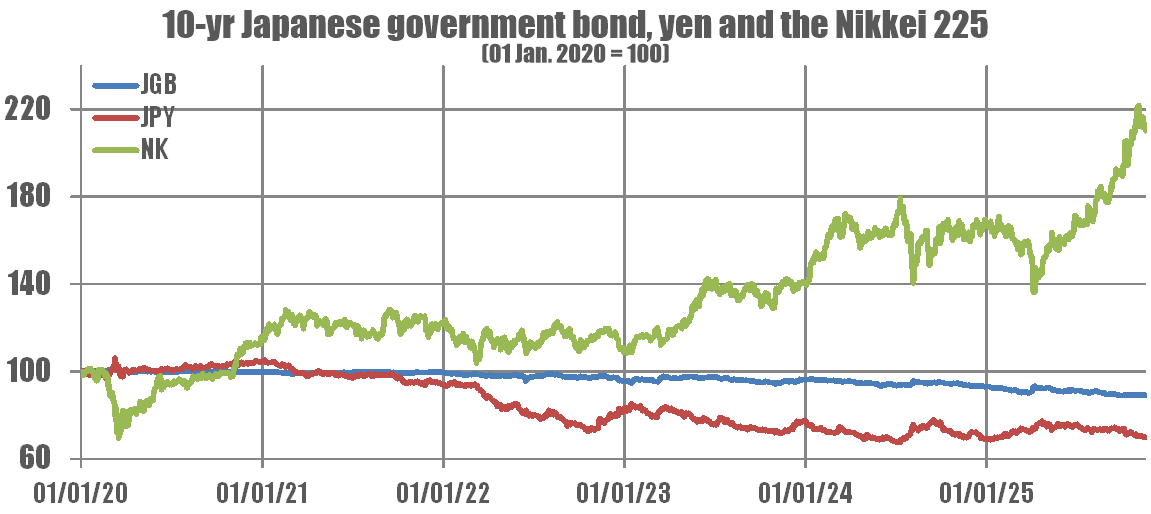

The Nikkei will rally

So far, three out of three predictions proved correct:

As the above chart shows, the price of Japanese government bonds (JGBs) have been in an unprecedented bear market. Over the same period, the yen has fallen and the Nikkei has soared:

As currency and debt turn worthless, equities tend to go vertical as we saw in many cases through history, including Venezuela, Zimbabwe, Argentina, Israel and the Weimar Republic. Thus, as Japan’s inflation accelerates, the Nikkei will likely also go vertical. However, the nominal gains in yen will still leave investors with close to total losses in real terms.

When Weimar inflation unwound in 1922, the total market capitalization of Daimler Benz was equal to the price of 327 of their cars. I suspect they must have had that many cars on their production lots and in their dealerships around Europe, so the company itself would be close to worthless.

Real estate prices also collapsed in real terms: villas in the upscale neighbourhoods at the outskirts of Berlin could be bought for 100 US dollars (which were still gold-backed at the time). The reason why even real assets turn worthless is that inflation indiscriminately annihilates the purchasing power in an economy. It really is a great reset.

Why all this matters

In a recent podcast on Geopolitics and Empire, Doug Casey said something that may seem obvious, but it is extremely important. He said that, going into the coming apocalypse, the most important thing everyone should try to do is, preserve one’s wealth to the best extent possible. In this sense, the way Japan’s crisis evolves will prove relevant for most nations in the west; as goes Japan, so will the UK and the EU go. Ultimately, even the United States is sliding along the same slippery slope.

Understanding the forces that are coming to bear on us is a matter of self-preservation. You’ll be of no use to anyone else unless you can assure your own economic survival. Therefore, the conclusion of this discussion is about practical solutions and some of the ways to weather the storm.

Predicting the endgame vs. navigating the events

It is one thing to predict the endgame and quite another to sail through the storm intact. Markets aren’t always “rational” and while Japan’s troubles have been discernible for many years, the markets reacted in ways that may seem counter-intuitive:

Interest rates on Japanese Government Bonds did not rise as government finances deteriorated; au contraire, they steadily declined and in 2016 and 2019 the JGBs even traded at negative yields

The yen did not fall of a cliff along with each BOJ quantitative easing; 12 years into QE (in 2012), it appreciated to an all-time high of less than 75 yen to the US dollar

The Nikkei vaulted from the low of 7,500 in 2009 to over 52,000 earlier this month

How does any of that make sense? If it does, please let me know. For my part, much of what’s happened since my 2010 article has been counterintuitive, but it has nevertheless taken the shape of sustained market trends. That part does make sense: large-scale price events (LSPEs) always unfold over time as trends, spanning weeks, months or even years. The silver lining in this complex equation is that LSPEs represent far and away the greatest source of risk and opportunity for traders.

As we advance through the Japanese, British, European and American crises, periodic tremors and market avalanches will set off financial tsunamis that will create LSPEs and trends. With the aid of effective trading strategies, all these crises could benefit the investor equipped with the requisite discipline and patience. Here we endeavor to provide the strategies; investors must cultivate the discipline and patience themselves. To the extent that they succeed, this exercise will be beneficial even in the face of unprecedented crises that lie ahead.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

Today’s trading signals

With Friday’s closing prices we have the following changes for the Key Markets portfolio: