Yesterday the Bank of England decided to cut interest rates by 0.25% with seven members of the monetary committee voting for this and two voting for a 0.5% cut. The markets took the news with some consternation, particularly because two of the committee members who voted for a 0.5% cut are known as policy hawks and that something they were looking at spooked them into voting for such a dovish rate cut. The BOE is overtly committed to bringing the inflation down to 2%. According to December 2024 CPI data, inflation is still above this target, at 2.5%.

The question is, why would the BOE be reducing the interest rates while inflation is well above its target? It is not exactly clear, but according to some reports, Britain's labor market is deteriorating rapidly as a consequence of Keir Starmer's economic policies, and the BOE must have taken the view that stimulating the economy at this point is more important than fighting inflation.

Not impulsive and reckless this time

In yesterday's press conference, BOE Governor Andrew Bailey said that the disinflationary trends are already in place, so everything will work out in the end, but those trends are slow, we must have patience. The central bank's "gradual and careful approach is appropriate," said Bailey. Well that's all good then, at least we can rest assured that they won't opt for the impulsive and reckless approach. Either way, the bank did not win markets' confidence yesterday. Then one of the journalists raised the question of delays in gold deliveries from the BOE vaults. Specifically, she asked, "how much gold left the Bank of England Vaults," and what the central bank was doing to alleviate the queues? BOE Deputy Governor, Markets and Banking Dave Rmsden took the question and in response delivered a word salad that only made things worse.

Ramsden conceded that there's strong demand for deliveries, but that gold is heavy stuff to handle and that he's having a harder time getting to work these days because there's lorries in the bullion yard. Not to worry, he said that only about 2% of gold stock left the BOE vaults since the end of 2024, so there's still loads of it there (400,000 gold bars minus 2%, presumably). However, it would have been much more interesting for us to know how much gold left since October 2024 because a large amount of gold was repatriated to the U.S. since the November elections.

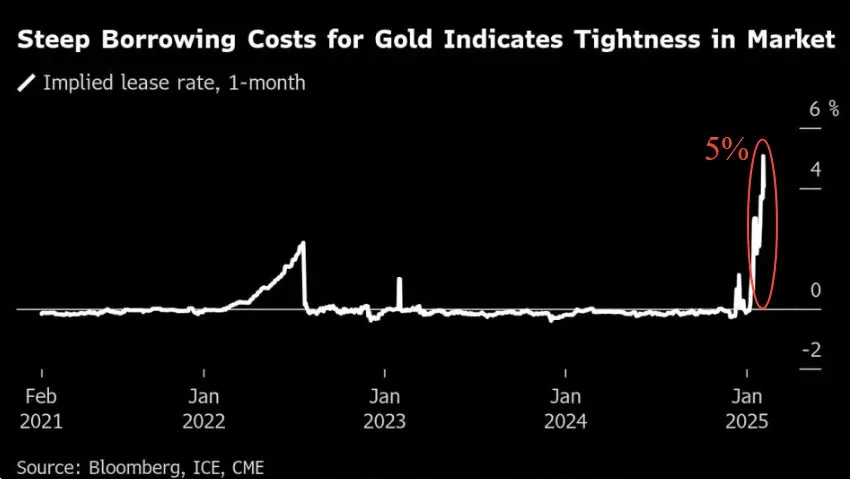

According to the FT, "Since November's US election, gold traders and financial institutions have moved 393 metric tonnes into the vaults of the Comex commodity exchange in New York..." In London, the rumors are that the LBMA bullion banks have run out of gold and are scrambling to borrow it from the BOE. This resulted in a massive spike in borrowing costs for gold:

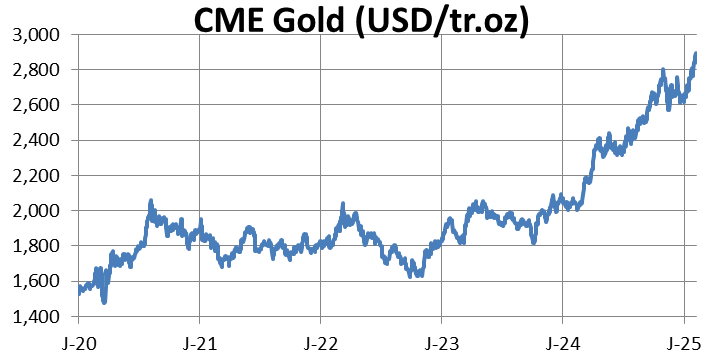

As a result, the price of gold has pushed past its all-time highs and is currently trading around $2,860/tr.oz, perhaps on its way toward $3,000 or higher.

Well, if you followed trends…

For TrendCompass subscribers, you didn't need to know all the complicated details about the gold market; our trading strategies have been recommending long exposure to the price of gold since November and December 2023 from an average price of $2,005/tr.oz. That trade would have generated a profit of about $855/tr.oz, corroborating once more our core hypotheses that:

As we head into another wave of accelerating inflation, it's worth remembering that in the 1970s, inflationary pressures pushed gold prices upward 24-fold during the 8 years from 1971 to 1980. Of course, we can never take advantage of past trends; we must be positioned today for events that will only unfold in the future and in this we must accept the uncertainty of these future events.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 7 Feb. 2025

With yesterday’s closing prices we have the following signals:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.