Behavioral economics and the psychology of speculation

Key Market report for Thursday, 27 February 2025

On Tuesday, 25 Feb. Michael Liebowitz (always worth a read) posted an article (link via ZeroHedge) about the significance of behavioral economics. The subject is central to investment speculation, but is not nearly as widely discussed and appreciated as it should be. Behavioral economics studies individual and group market psychology in order to better understand how individuals make investment decisions. This could hardly be more relevant to our purpose here, as all our investment results depend on the decisions we take and execute. That's pure psychology: regardless of what is going on in the economy and what information we are exposed to, our performance depends on what we do.

As Liebowitz points out, "investor behavioral instincts are the most critical driver of short-term gyrations and the least discussed by the media. Given psychology’s outsized yet underappreciated role in financial markets, let’s learn how to better govern our inner voice, leading to more rational decision-making."

On the whole, his article summarizes much of the same ground I covered in my books "Mastering Uncertainty in Commodities Trading," and the "Trend Following Bible," including the anchoring bias, loss aversion, overconfidence and herd behavior. These biases, in addition to distraction and emotion make it difficult for any individual investor to perform in line with market benchmarks, let alone outperform them.

It’s all about confidence

For example, we are naturally inclined to follow the actions of others, which gives rise to market trends and bubbles, which are now being inflated in many securities markets. In most Western economies, stock markets are at or near all time highs and still, the S&P 500 had two consecutive 20%+ gains. With good performance, investors grow confident and inclined to take on more risk. That, however, will ultimately lead to trouble: ultimately, all bubbles burst and those who were most confident and most daring end up sustaining the most devastating losses.

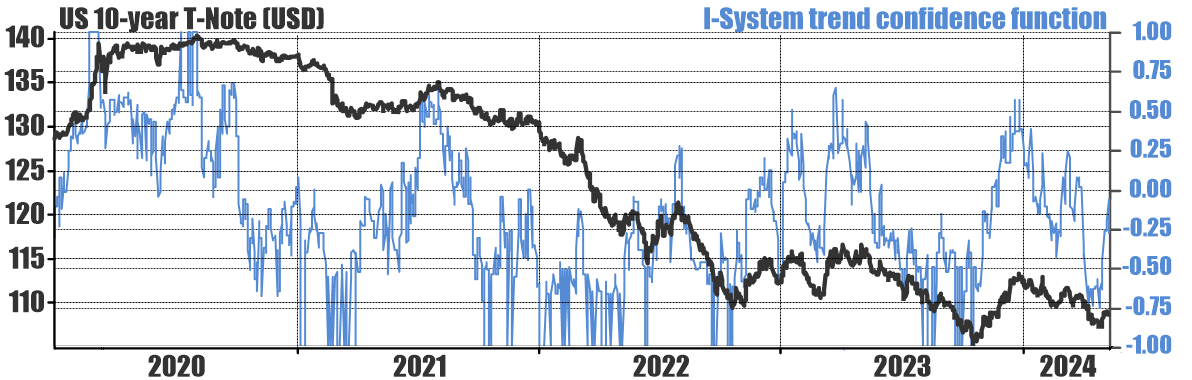

On the other hand, taking decisive action is difficult if our confidence levels are low. To solve this problem and isolate judgment and decision making faculties from our cognitive biases my team and I developed the I-System. One of its two neural networks, illustrated below, consists of a set of algorithms that generate the trend judgment, or trend confidence function.

I-System's trend confidence function fluctuates between -1 and 1, where -1 signifies full, 100% confidence that we are observing a downtrend in a given market, and 1 signifies 100% confidence that we're in an uptrend. The following chart shows I-System trend confidence function overlaying the price of US 10-year Note futures:

The ability to calculate this function in a way that's consistent and numerically exact allows us to determine the optimum threshold of confidence that justifies taking risk. It turns out that this level is invariably below 50%. For a human being, it would be near impossible to be always completely consistent in gauging their confidence, let alone venturing into risky trades while their confidence is below 50%! At the same time, waiting to be 100% confident could inhibit us from making good investments at the right time. By the time we’re fully confident about something, the chances are that it’s already obvious to everyone else.

Transcending biases, distraction, greed and fear

A strategic and systematized approach to decision making enables us to side-step our many unhelpful cognitive biases, but it does much more than that: it makes it possible for us to measure the performance of our investment strategies and set expectations of future results. That enables us to determine the amount of risk we should be taking on our investments. If the actual results of our trading turn out significantly different from what we expected, we can revisit and readjust our strategy. All this is difficult to do if we only rely on discretionary decision making, to say nothing about the stress that comes with it.

Best of all, systematic trend following enables us to transcend the “home/familiarity” bias: a strong tendency to invest in industries and geographies we’re familiar with. But once we master the methods of trend following, we can apply them in any market, even if we don’t know much about them. That knowledge entitles us to the only free lunch there is in the markets: diversification, which allows us to target the same returns with less risk, or to target higher returns with the same level of risk.

It still takes strategy, discipline, patience…

This is not to say that systematic trading is the quick and easy solution to the challenge of investment speculation: it always involves a sequence of good periods and bad periods. However, with a well thought-out strategy, a consistent approach, discipline and patience, we are far more likely to attain satisfying results from our investments and grow our wealth over the long term. The same is true for other approaches to investing and Michael Liebowitz appropriately underscores Warren Buffett's statement that “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

I could take issue with Buffett's ten year horizon, but it is certainly true that investing should properly be regarded as a marathon in which success compounds from a long sequence of transactions. Not every transaction will be profitable and not every year will be positive. But on a three year horizon, the process should definitely be building up steadily to the upside and grow from there. That’s what we built the I-System for - in order to:

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 27 Feb. 2025

With yesterday’s closing prices we have the following signals:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.