The UK can't seem to catch a break and bad news follows bad news. On Saturday, The Guardian published an article titled, "All UK families 'to be worse off' by 2030' as poor bear the brunt, new data warns." In short, the news is bleak and the government seems determined to double down on policies that make it so. But this shouldn't come as a surprise: it's almost exactly what I had predicted they'd do back in 2021.

In my article, "The Fall of Global Britain: an Investment Hypothesis," I suggested that Britain "won't revert to simply minding its own domestic affairs as a neutral island nation, and will endeavor to regain its lost hegemony to the bitter end." I also predicted that, "The UK will ... suffocate its domestic economic growth by imposing hard austerity at home while at the same time increasing military spending and foreign adventurism. Britain's public debt will continue to outpace its GDP growth and the government's budget deficits will be covered by Bank of England's monetary inflation. This recipe reliably leads to stagflation and possibly to hyperinflation."

Last year, afterthe Keir Starmer cabinet passed their 30 October 2024 budget, we were being convinced that the UK would turn a corner, that growth would begin to pick up and that inflation would remain completely tame and under control: happy times! But all that was mostly based on narrative peddling, not reality.

From 16 Dec. 2024 TrendCompass: "UK’s Office of Budget Responsibility (OBR) did their part to apply lipstick on the proverbial pig with some suspiciously rosy-looking forecasts. They projected that the government's budget deficits will stay at around 2.5% through 2029. Inflation will stay perfectly under control, peaking at 2.6% in 2025 and then gradually fall back to 2% by 2029. The OBR also revised Britain’s 2024 GDP growth rate to 1.1%, up from 0.8% in March. In 2025, the GDP growth will soar to 2%."

Bad to worse

Well, now The Guardian reports that the OBR will have to slash their rosy 2% GDP growth forecast by half, right back to 1% which could ultimately prove to be still too optimistic - give it time. In all, based on the most recent report from Joseph Rowntree Foundation (JRF), British families can look forward to their standards of living declining through 2030. The average family "will be £1,400 worse off by 2030, representing a 3% fall in their disposable incomes. The lowest income families will be £900 a year worse off, amounting to a 6% fall in the amount they have to spend."

In addition to crushing ordinary people, this amounts to a catastrophic loss of purchasing power in an economy where independent businesses have already been struggling, bankruptcies are rising, where one in five households already have difficulties paying their bills and where retail shops are losing business, not to competition but to poverty.

Obscene levels of destitution

Last year, The Guardian published an article about the rising poverty in Britain titled, "Gordon Brown slams 'obscene' levels of destitution in the UK." Its opening paragraph stated that, "Britain is in the throes of a hidden poverty epidemic, with the worst-affected households living in squalor and going without food, heating and everyday basics such as clean clothes and toothpaste..." No matter, Starmer and his Chancellor Rachel Reeves are determined to press on with savage austerity against the most vulnerable people at home while at the same time upping their commitments to imperial misadventures abroad.

The Bank of England who, together with the Budget of Office Responsibility are actually in charge of the government policy (according to former PM Liz Truss), could not care less. Recall how Bank of England's top economist, Huw Pill, said that the lowly Brits simply need "to accept that they're worse off and stop trying to maintain their real spending power by bidding up prices..." Paroting the same mindset, the Bank's Governor, Andrew Bailey admonished British workers not to demand pay raises in order to do their part in the fight against inflation.

But alas, the deplorable people of Britain are not listening to the wise counsel of their good bankers: according to the Guardian, “Real wages are rising at the highest level in six months..." That translates into strong inflationary pressures, since every business in any economy depends on labor - it's the one thing that's hard to substitute or import (they are trying). The government (read, BOE and OBR) have a choice: print like crazy or risk a deflationary depression.

Gilt and pound down; equities up…

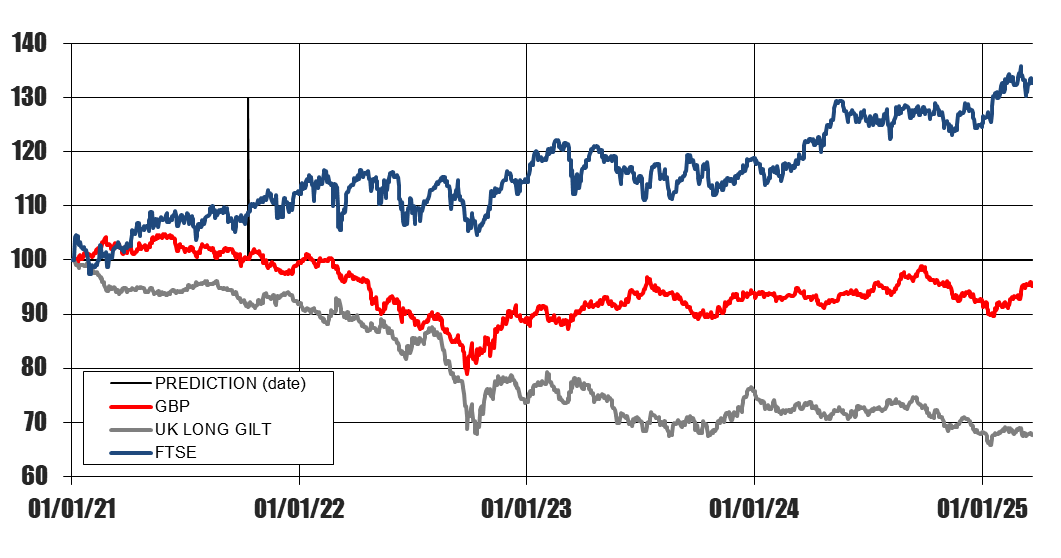

So... back to my 2021 forecast about the fall of Britain: “… at a macro level, we can expect the following developments over the coming months and years: asset prices will probably continue to rise (i.e. a bullish cycle for the FTSE 100), but the government bonds will continue to slide along with the British pound.” So far, so good: since 2021, the pound has declined about 5% against the dollar, the gilt has lost more than 30%, and FTSE gained over 30%. Here's that chart:

Again, as these curves show, large-scale price events have been, and will probably continue to unfold as trends, enabling trend followers to systematically generate windfalls over time. Systematically is not to say smoothly, or regularly: trend following gains always entail some volatility and adverse price moves. But over the long term, it is the most reliable way to navigate markets.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 24 March 2025

With Friday’s closing prices we have the following change:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.