In the last three weeks, the S&P 500 lost nearly 9%. Such sharp pullbacks often cause investors to fear that we're looking at the beginnings of a bear market and there's no shortage of experts who'll make that prediction.

Experts and market predictions

One of the most prominent market analysts, John Hussman wrote that, "The present combination of historically rich valuations, unfavorable internals, and extreme overextension places our market return/risk estimates – near-term, intermediate, full-cycle, and even 10-12 year, at the most negative extremes we define. Yes, this is a bubble in my view. Yes, I believe it will end in tears.” Hussman believes that S&P 500 would need to drop by 64% to "restore run-of-the-mill long-term prospective returns."

Hussman's analyses are usually well reasoned and compelling. The only problem is that he made the above prediction in August 2023 while the S&P 500 was trading below 4,500, and from there, the S&P appreciated more than 25%, underscoring once more our strong belief that in investment speculation, making accurate predictions with any degree of consistency is simply impossible, regardless of the forecaster's sophistication.

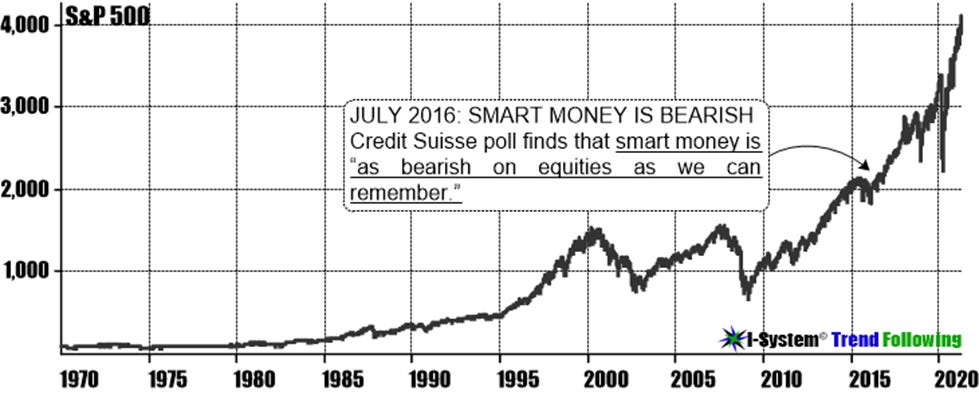

I do believe that markets move in trends (see also the above chart), but trends aren't predictable either. Rather than trying to predict anything, investors would be better served by diversifying their portfolios across a range of non correlated markets and one of the best venues for diversification are commodity futures (or alternatively to corresponding ETFs or CFD contracts).

Commodities: the empirical angle

About a month before Hussman made his forecast, Sushil Wadhwani wrote an article titled, "The Case of Why Investors Should Diversify with CTA" published in the Financial Times. Wadhwani is a fellow trend follower, CIO of PGIM Wadhwani and former member of the Bank of England Monetary Policy Committee, which all makes him a rare trend follower who is not an outsider to the institutional world of finance.

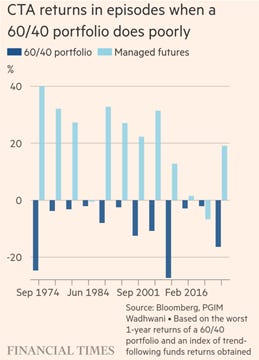

The gyst and content of Wadhwani's article will be familiar to longer-term subscribers to this newsletter: it reflects the same strategy and the same philosophy of investment management. Wadhwani points out that in 2022, a traditional investor portfolio of 60 per cent in equities and 40 per cent in bonds registered a double-digit percentage loss and adds that,

"We have seen such disappointing out-turns for a 60/40 portfolio before now during past periods of high inflation, such as 1973-74, and recessions, such as in 2008." By contrast, In 2022, CTA strategies, on average, registered double-digit gains after fees. This was not a fluke but a long-established merit of CTA strategies. Wadhwani continues: "We looked at the dozen worst periods in over the last five decades for a 60/40 portfolio, in terms of its one-year losses, and how CTA funds performed in each episode (excluding our own funds). In 11 out of the 12 episodes, CTAs outperformed — and with an average gain of 19.9 per cent."

This quality is due to CTA strategies having the advantage of being agile — able to respond nimbly if the macroeconomic conditions deteriorate.

During the seven recessions identified by the US National Bureau of Economic Research since 1973, for example, CTAs have offered traditional investors much needed protection — with an average return of 11.6 percent per annum, thus outperforming a 60/40 portfolio 8.3 percentage points. It is quite clear that diversified trend following practiced by CTAs is almost the perfect portfolio diversifier, in addition to being the single most effective inflation hedges.

Not just a ‘rainy day’ strategy

But trend following isn't merely an insurance policy for rainy days - it is a resilient investment strategy for sunny days also. Writes Wadhwani:

"It is important to not think of CTAs as akin to an insurance policy ... CTAs can and often do make money even when the sun is shining. When we look at the past 50 years of data, in periods when the 60/40 portfolio made money, so, generally, did CTAs — and at a healthy average annual rate of 8.6 per cent (using our index of CTA returns since 1973). This is because CTAs are often long equities during such periods."

If this is so, then why don't all investors have an allocation to this strategy? Wadhwani notes that investor allocation to CTA strategies is minimal and comments that, "The low allocation is puzzling to us but, in our experience, often relates to the desire on the part of trustees to not deviate too much from what is conventional." That's a nice way to say, groupthink.

Key to success: discipline and patience

Indeed; I often get the question - well, if trend following is so great, why isn't everyone a trend follower? I think it would be a bit like if you discovered an effective homeopathic remedy to some ailment and proposed it to the World Health Organization or the healthcare industry. It would not much matter how effective the remedy was: we don't do homeopathy and that's that!

In reading Wadhwani's article, I was glad to note that he also brought up patience as the essential prerequisite for successful investing: "Most investment strategies suffer from drawdowns. Thus, investors need to be patient. This is true as much for CTA strategies as it is for 'long-only investments." In fact, I believe this is true for any and all investment speculation. I will elaborate further on that theme in tomorrow's report.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 11 March 2025

With yesterday’s closing prices we have the following changes:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.