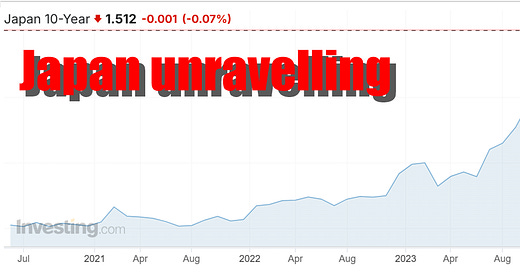

Last week, the yield on 10-year Japanese Government Bond (JGB) broke decisively above 1.5%, the highest level in 15 years! As recently as 2021, JGB traded below 0% yield but since then, we’ve seen a sustained upward trend:

We could be witnessing the final unravelling of a crisis whose seeds had been planted decades ago. Its ultimate outcome has been discernible for a very long time. In March of 2010 I published an article titled, “Japan: the Harbinger of (bad) things to come,” and updated it 12 years later, in 2022:

I opened with the following sentence:

“Large and gathering imbalances brewing in the Japanese economy threaten to generate a tsunami-like fallout that could soak most of the global economy.”

The following paragraph addressed the essence of the imbalance:

“[The] eroding household wealth in Japan has stalled demand for JGBs [Japanese Government Bonds]. This has contributed to a sharp rise in the ratio of government revenues generated from bond issuance to that generated by tax collection, from about 50% in 2007 to 90% in 2009. … With the government deficit running at over 40% of expenditure and Japan’s savers buying less government debt, who will finance Japan’s deficit in the future? The JGBs yield of 1.5% would need to triple before it could attract international bond investors.“

As it happened, the JGBs not only didn’t triple from the 1.5% level, but over the next 10 years it continued sliding lower, falling below zero by 2016 and staying near that level for about 5 years, until mid-2020 - a surprising turn of events, to say the least. The Bank of Japan (BOJ), with support from the US Federal Reserve has been able to stave off collapse by stepping in as the buyer of government and corporate bonds (and stocks) with unlimited free money.

The curse of free money

But delaying the unravelling of the financial and economic imbalances with a flood of free money will almost certainly prove hugely destructive. At the same time as Japan has the world’s highest debt-to-GDP ratio in the developed world (260%), Japan is also the world’s largest creditor nation, holding around $3 trillion in foreign assets, including US Treasuries. As of last November, Japan owned about $1.09 trillion in U.S. Treasuries, making it the largest foreign holder of U.S. debt.

Japan’s free money bonanza also gave rise to a colossal carry trade where investors borrowed yen (almost for free), converted it to US dollars and used the proceeds to purchase much higher-yielding assets like US Treasuries, corporate bonds and stocks. But the carry trade only works if there’s a sufficiently large interest rate gap between the cheap and expensive money. Now that the Japanese yields are rising, the carry trade has begun to unwind, which led to a sharp, 25% crash in the Nikkei index last summer, from the peak level of around 41,750 to the August 2024 trough at around 30,800.

Although the Nikkei partially recovered and didn’t slip into a bear market, it never regained its 2024 peaks, or its prior uptrend. Rather, the episode foreshadowed Japan’s (and world’s) vulnerability to further unwinding of the Japanese carry trade and Japan’s divestment from foreign assets. The rise in yields we’ve seen since 2021 has resulted in very significant capital losses on treasury holdings of Japanese institutions like banks, pension funds and insurance companies. One report suggested that Japan’s insurers sustained $60 billion in paper losses; Japan’s largest insurance company, Nippon Life alone has a $25 billion loss.

It’s far from over

The crisis is far from over, however. A few months ago, JPMorgan suggested that 2024 was only the beginning of the carry trade’s unwinding and that more pain might lie ahead. It will continue to push yields higher, not only in Japan but worldwide, and this could put downward pressure on asset prices in general. It could also slow or even reverse Japan’s buying of US debt, forcing US Treasury yields further up and pushing the Fed to unleash QE where Japan stalled. In fact, this may already be happening; as Lau Vegys wrote in his latest piece for Doug Casey Crisis Investing, last Wednesday, US Government had a failed bonds auction:

On Wednesday afternoon, the U.S. government tried to borrow $16 billion through a routine Treasury auction. But it turned into a complete disaster. So bad, in fact, that the Federal Reserve had to quietly step in and buy $2.19 billion worth of bonds that private investors didn't want.

What happens next

Back in 2022, I made a prediction about the developments we can expect in Japan:

QUOTE

Broadly speaking, we can make three predictions about Japan’s economy:

We’ll see a period of stagflation (inflation + recession) and the inflation part could ultimately morph into a hyperinflation;

Interest rates will continue to rise and the price of Japanese Government Bonds will collapse. I believe that the unravelling could resemble what Germany had experienced 100 years ago;

The Nikkei will rally

UNQUOTE

Well, Japan is in a stagflation and inflation is picking up, including food inflation. Interest rates have risen strongly and will probably continue to rise over the long term. The Nikkei did rally, but it is uncertain whether and when this trend might resume, given that the BOJ is now resisting the QE impulse. Ultimately however, the BOJ will be forced to capitulate, ramp the printing presses back up and sacrifice the yen.

How to navigate the fallout?

So what are the practical solutions? Well, this newsletter is a good start, given that it includes the JGBs, Japanese yen and the Nikkei. Furthermore, it generates signals on the basis of market trends, rather than fundamentals analysis or opinions. As the above article perfectly illustrates, a fundamentals analysis can help us see a crisis coming long before it actually materializes. Had I ventured to trade on the basis of such an analysis and my own convictions, I would have had to be prepared to be wrong for 12 years or so.

These issues are typical for fundamentals analysis; they are among the reasons why trend following is a much more reliable and more profitable guide to navigating markets. For any investor, trend following should be part of the essential decision support toolkit. At the very least, it should be used as a source of reality check and second opinion about market developments.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

Today’s trading signals

With yesterday’s closing prices we have the following changes for the Key Markets portfolio:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.