Remember, all decisions are made on the basis of models. … The heart of the matter is your relative degree of confidence in each of these models.

Jay W. Forrester

I-System Trend Following is based on twin hypotheses:

Large-scale price events are unpredictable. We can never be certain when they'll take off, how long they'd last or how high (or low) they might reach. What we do know however, is that LSPEs invariably unfold as trends that can span weeks, months or even years. Trend following therefore provides us a way to capture windfall profits from these events even if we don't know the future.

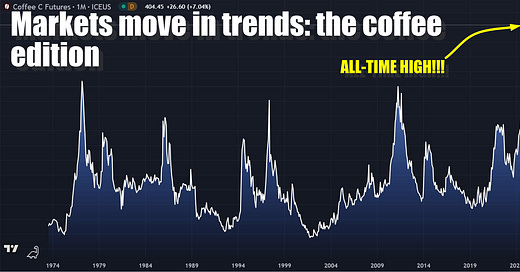

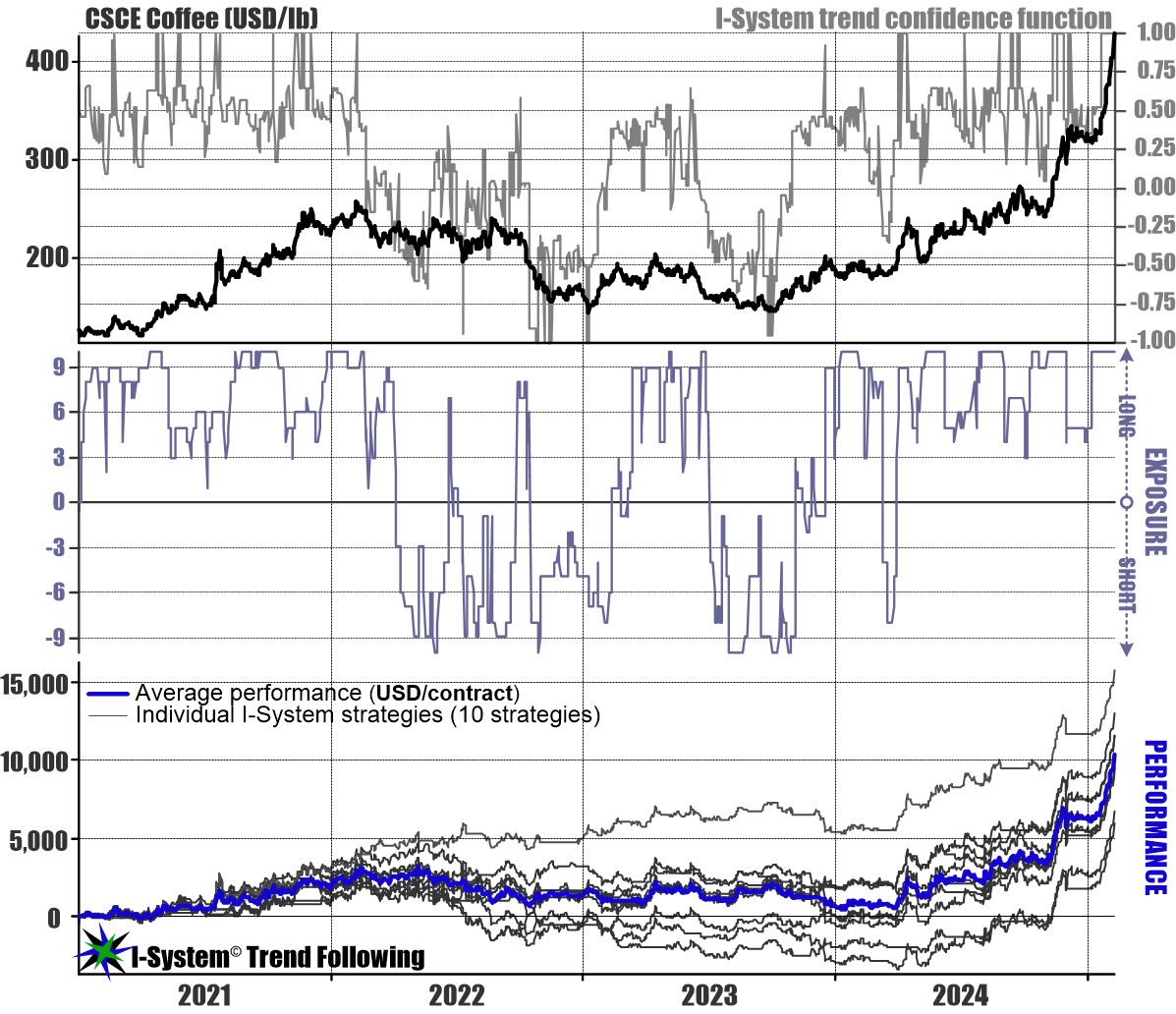

The most recent example of this is the coffee market. Coffee prices made new all-time highs over the last ten consecutive trading sessions. The exhibit below shows the evolution of coffee prices since 2021 and the performance of a set of 10 I-System trend following strategies over that time:

In the top chart we have the daily CSCE Coffee price (US cents/lb, left-hand axis), overlaid with the I-System trend confidence function (right axis). Trend confidence fluctuates between -100 (certainty that we're in a downtrend) and 100 (certainty that we're in an uptrend). The middle chart shows net exposure of the ten I-System strategies, fluctuating between -10 (denoting a full short position) to 10 (a full long position). The bottom chart shows the performance of each strategy individually as well as their average performance in US dollars per single CSCE coffee contract (each CSCE coffee contract calls for an exchange of 37,500 lbs of coffee).

The functions illustrated above and the algorithms calculating them are described in greater detail on this page: https://isystem-tf.com/technology/

Trends are not predictable

A few observations are in order: markets don't always trend and during 2022 and 2023 we experienced a rather bumpy sideways drift. During that time trend following strategies tend to have a flat or negative performance. However, during trending periods they do catch significant trading profits, as we've experienced through 2021 and 2024/2025 thus far. Over the years, I've heard many investors ask whether we could just wait until the market starts trending and improve performance by only trading during those trending periods?

Yes, we could improve trading results in that way, if only we could predict when trends would start and when they would stop. Unfortunately, that’s out of the question: after more than 25 years in the markets, I still don't know of anyone who can consistently make such predictions. Forecasts based on so-called fundamentals research is useless. This last leg of the bull market in coffee has started in late 2023 or early 2024. Today we may read that coffee is going up because of bad weather in Vietnam, strength of Brazilian real and the rapid rise in coffee consumption in China.

That’s all very helpful, except when the rally started coffee wasn’t in the news much and few analysts had very strong opinions about it. Now that that we’re at all-time highs, opinions, analyses and explanations are a dime a dozen but too late to profit from the trade. By contrast, as you can see from the chart above, I-System strategies switched from net short to net long in late 2023 and have been net long ever since, generating on average close to $10,000 per CSCE coffee contract.

Strategy + discipline + patience = success

Could anyone have known this would happen? No, and neither did we. As with all other speculative endeavors in life, our only choice is to follow a strategy, take our positions, accept risks and wait for trends. This is why, in addition to a methodology, or strategy, trend following requires iron discipline and a good deal of patience.

Today, a handful of markets including coffee and gold are trending strongly; tomorrow trends will emerge in other markets. The great advantage of trend following is that we can use the same basic methodology in any market even if we don't have deep knowledge about them. This allows us to diversify our risk and benefit from trends in many markets.

I know close to nothing about the market for coffee, but thanks to I-System Trend Following, I've been able to trade it successfully throughout my career. I believe that the momentous changes happening in the world today will give rise to many new trends, not only in precious metals and agricultural commodities but also in energy, currencies, bonds and stock indices, which are included in this newsletter.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 11 Feb. 2025

With yesterday’s closing prices we have the following signals:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.