Practicing calligraphy can boost your investment returns! (no, really...)

Key Markets report for Tuesday, 20 January 2026

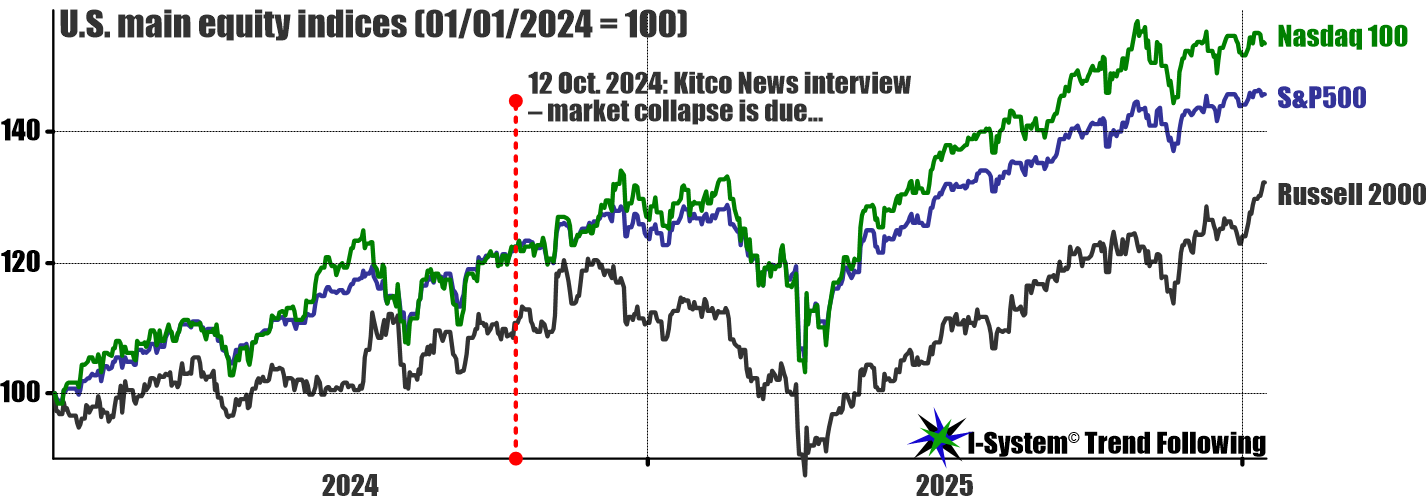

Yesterday we had a partial closure of U.S. markets for the Martin Luther King Birthday holiday. Also, yesterday YouTube decided, for some reason, to remind me of a Dave Collum interview published by Kitco News on 12 October 2024 titled, “Markets Overvalued by 150% as Dishonest Metrics Hide the Coming ‘Catastrophic’ Collapse: Dave Collum.”

I count myself as a fan of Dave Collum: I very much enjoy his articles and his interviews, which are invariably informative, educational and amusing. Collum is a Professor of Organic Chemistry at Cornell University and a rigorous, learned scientist. He is also a very lucid observer of world markets and politics and has been extraordinarily successful as an investor. Collum was completely right in saying that they’re dishonest, not just inaccurate. That’s one of the key reasons why wasting time on econometric analysis and forecasting makes little sense.

Predictions are a 50/50 thing

But in this particular interview, Collum did venture to make a prediction: he said that the economy was starting to roll over, that markets were overvalued by 150% and that investors would “give it all back in a catastrophic” correction. To be fair, Collum did not say when this would happen, but in saying that the economy is starting to roll over, he implied that this correction might be imminent. At any rate, my point here isn’t to dispute Dave Collum, but to underscore that predictions are for chumps!

It doesn’t matter how smart or sophisticated the predictor, their predictions will always tend to be a 50/50 proposition. Any individual prediction will prove either right or wrong and over time, about half the predictions will turn out broadly correct and the other half incorrect. This is extremely important to keep in mind because most analysts, investors and even professional investment managers make investment decisions on the basis of forecasts.

The entrenched conceptual mismatch

That’s an empirical fact: according to a T. Rowe Price Global Investment Services and Citigroup survey of asset managers and pension funds from 37 countries, managing some $30 trillion in assets, well over 605 of these professionals reported that they relied most heavily on economic forecasts for their investment decisions. This may well be the reason why most of them by far tend to underperform their strategy benchmarks!

Clearly, if most people use a certain approach to decision making and most of them fail to achieve their objectives, then perhaps there’s a conceptual mismatch between the problem at hand and the approach, or method applied to solving that problem. A book could be written about this, but do keep this in mind when you hear phrases like “smart money,” or “sophisticated investors.” For our purpose here, it should be instructive to look at the evolution of equity markets since the said Kitco interview:

In fairness, Collum’s hunch was spot on. Unlike many analysts, he ventured his prediction as the market was near market peaks, when most investors enjoy care-free returns. Most analysts begin to pile into bear-market predictions only when the pullback is quite obvious.

Nevertheless, the pullback of 2025 was only a temporary correction after which the markets would continue rising toward new all-time highs. Today, fifteen months after that Kitco interview, the market is significantly more overvalued than it was then. For all the sense that any of that makes, in another 15 months, it could be higher still.

How calligraphy could help

In the end… investors must make peace with the fact that markets move in trends. All the time and effort spent on economic analyses, statistics and aggregates, valuations and predictions is the time better spent on more gratifying pursuits in life. Reallocating that time to activities like playing tennis, fishing, calligraphy or even playing video games could even improve your trading performance.

It may seem like an exaggeration to say that calligraphy (or fishing, or staring at a wall…) can actually improve your investment performance, but I believe it can by getting your mind off of market matters. Psychologist Paul Andreassen at the Massachusetts Institute of Technology looked at the way access to information influenced investment performance.

He divided students into two groups whose participants each selected a portfolio of stock investments. In each group, students were free to buy and sell stocks as they saw fit, but while one group had access to the constant flow of stock market news, the other group was allowed to monitor their portfolios only through changes in stock prices. The experiment showed that students who got no financial news at all earned double the returns of those who frequently checked the news.

In this sense, practicing calligraphy (or anything else) can keep you occupied with something more interesting than digesting reams of distorted and dishonest figures, fake news and toxic psyops. The obvious alternative is to follow trends so you can profit from large-scale price events in markets with confidence and peace of mind.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

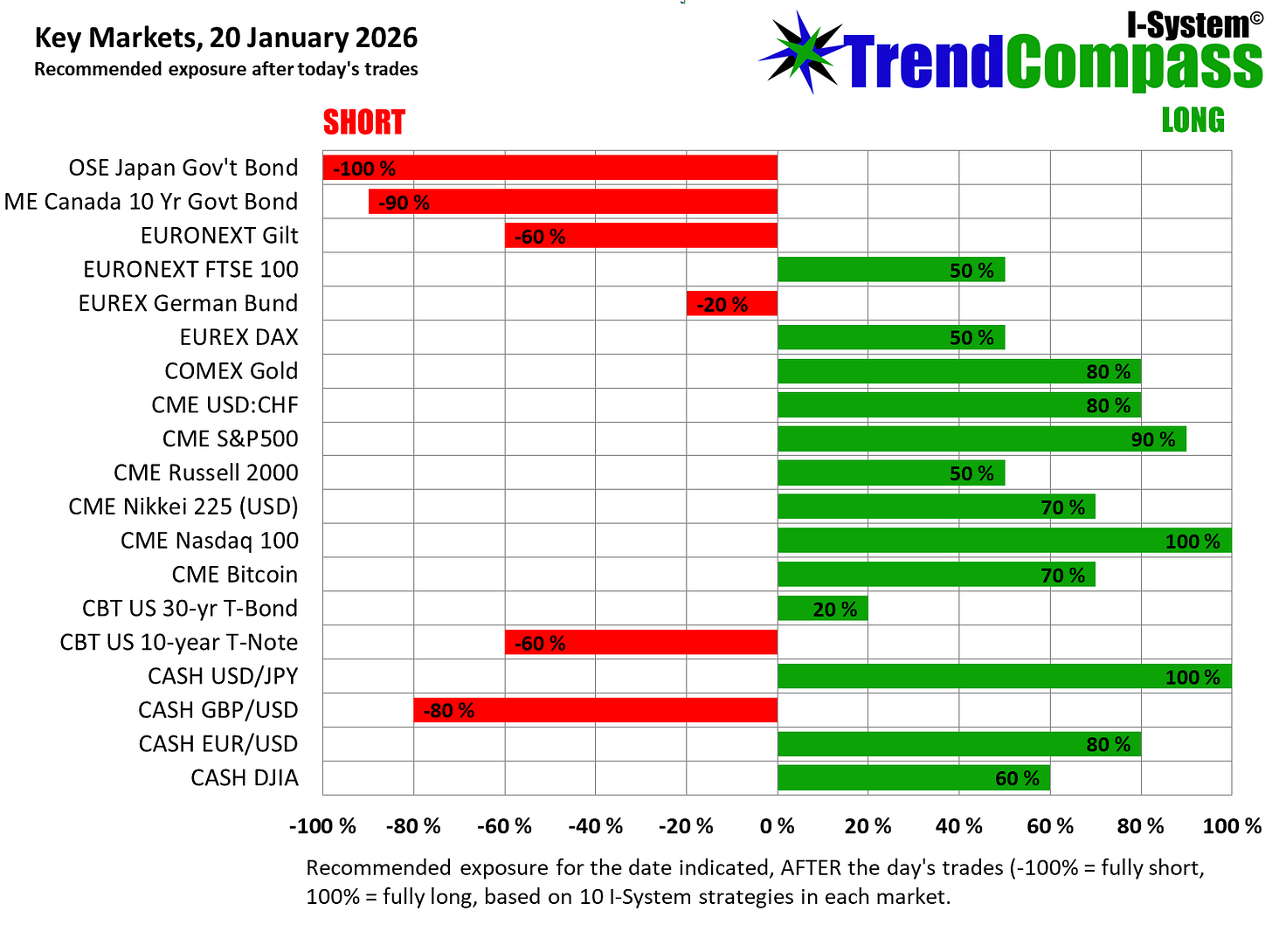

Today’s trading signals

We have no new trading signals to report today for the Key Markets portfolio. Your exposure should remain unchanged, as follows:

There is no attachment with today’s report.

Best regards,

Alex Krainer

Or...Jig saw puzzles, raking leaves, gardening...

I’ve just begun to learn about day trading, swing trades, etc. I will be checking in to your system as I absorb this new information. Thank you, Alex, for sharing your expertise. I find your understanding of geopolitics and economics refreshing and enlightening. You give what my gut instincts knows credibility with your extensive knowledge of history.