For many years now we've read and listened to gold bugs expound on why the price of gold will go up, much higher from where it is now. Just to be clear, my using the nickname gold bugs is not meant to be derogatory in the slightest. During most of this decade however, the price of gold has been stuck between about $1,800 and $2,000 per troy ounce in a fairly bumpy horizontal drift.

The "bitcoin bugs" poked fun at the dinosaurs who still believe in gold, which has underperformed miserably when compared to bitcoin and some other crypto wonders. But about 12 months ago, gold made a decisive break out of its range and has now broken new all-time highs, just short of $3,000/tr.oz.

Given the massive debt overhang in the US economy, the budget deficits, the QE and the price inflation, and central bank hoarding of gold, it stands to reason that the price might continue to rise over the coming years. This is redeeming for the gold bugs but their forecasts about how high the price of gold might go range very widely, from $3,200 to beyond $20,000. This last number might seem excessive, but it might not be. The last time the US economy endured an episode of high inflation, the price of gold rose nearly 24-fold: from under $35/tr.oz in 1970 to $850 in 1980.

Furthermore, the new administration in Washington has signaled that they are serious about monetizing the assets held in the US Treasury, which could give a significant boost to the gold price. If the administration proceeds with this plan, it could be in their interest to see the price of gold rise much higher from the current levels.

Then there are more esoteric interpretations about the nature of the nature of political conflicts unfolding in the world today, which hold that the Trump administration's adversary is an imperialistic globalist cabal controlled by the international banking cartel whose power rests on their control of the dollarized economy in the world and that weakening and defeating this cabal would involve collapsing the US dollar and replacing it with an alternative currency controlled by a different center of power.

For sure, there's some truth to those interpretations, but it would be very difficult to make any predictions on that basis. Already the way things are evolving, we are moving into uncharted waters with outcomes that are very hard to foresee.

At any rate, for our purposes it is less important to make the right predictions and more important to take the correct directional exposure to the evolving price trends. Admittedly, the past four years of range-bound price drift have made gold a painful market to trade, but once a clear trend emerged, our strategies haven't failed to pick up the ensuing windfalls. Whatever the future holds, I expect this to continue, not only with respect to the price of gold but also other metals, energy, agricultural markets, currencies, stocks and bonds.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

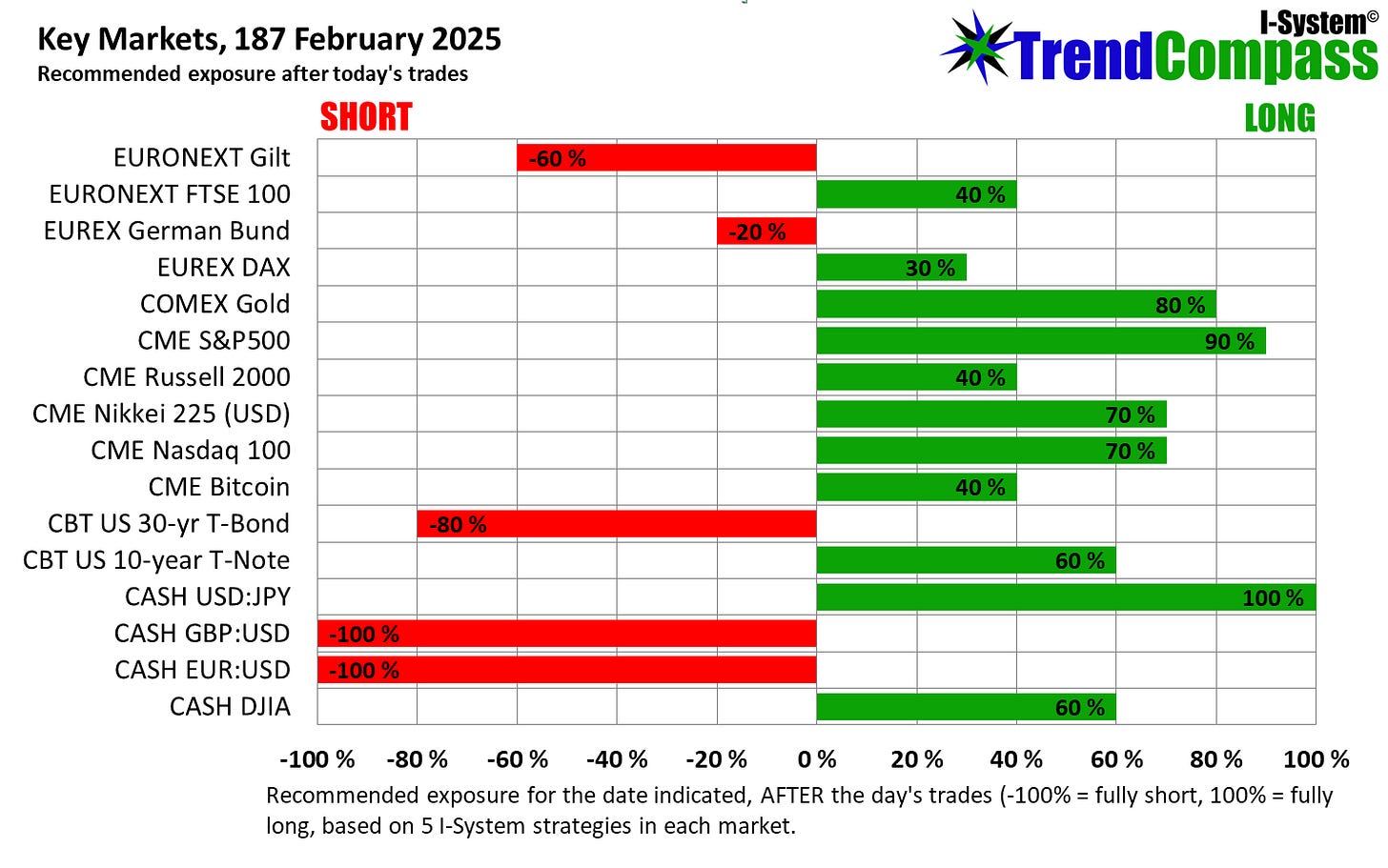

Trading signals for Key Markets, 18 Feb. 2025

Due to George Washington’s birthday holiday, US markets were closed and we have no new signals to report today. Your exposure should remain unchanged, as follows:

Best regards,

Alex Krainer

Best regards back.

Could it be that in this era of super-fast and widely disseminated media, that the new 'nastis' are just rebranded oldies?

T has been selling his wares in European media since well before he first assumed power, at the same time Europe, including so-called UK, have been falling over themselves to become overtly 'nasti'.

Perfect timing for the blond saviour to save Germany et al with new 'gold?' shipped in from UK (nice story) backing a utopian money, smile please!