The twin hypotheses behind the I-System Trend Following approach to portfolio management are that:

Both hypotheses are discussed in more depth in the linked articles. Even for investors who prefer fundamentals-based investing or value investing, trend following should at the very least be considered as an important source of bias-free second opinion. Better still, it should be used as a strategic diversifier.

However, it is extremely important to also understand the limitations of trend following; like with many other things, it will prove beneficial only to the extent that we use it appropriately. This is true about most other useful things like tools, machines, weapons, medicines and cars. And just as we have to learn how to use these tools, or follow instructions to derive benefits from them (as opposed to getting hurt), the same is true about trend following.

The performance dynamics of trend following

Our underlying belief is that markets move in trends: no trends, no performance. Trend following strategies function by continuously positioning investment risk in the direction of the prevailing price trend, but the windfall profits only materialize when trends materialize. If they don't - if security prices drift sideways, or when a trend reverses, trend following strategies will sustain losses.

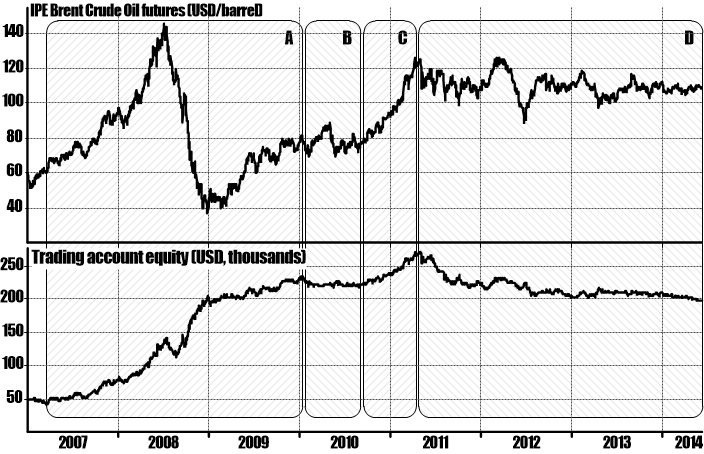

This chart shows the performance of a typical I-System strategy trading Brent crude oil futures (actual results, not a back-test). The strategy started with an initial risk budget of $50,000 and trades a single 1,000-barrel contract ($ 50/bbl). From 2007 through mid-2008, oil rallied from $50/bbl to about $146/bbl. Over the following six months, it collapsed to $40/bbl. In 2009, the trend reversed again and the price doubled from $40 to $80/bbl. These were very favorable winds for trend sailors.

Panels A, B, C, and D show four distinct phases in this interval:

A: strongly trending price offered very high returns on trend following. The above strategy generated a return of over 300% from January 2007 through December of 2009, with only one major drawdown in the wake of the trend’s reversal in mid-2008. This draw-down may appear small, but it amounted to about 60% of the strategy’s risk budget.

B: price consolidates around the $80/bbl level. When prices fluctuate in a sideways range, trend-following strategies tend to generate losses.

C: In late 2010, the price broke out of its range and advanced another 50% from the $80/bbl level, enabling further trading gains.

D: The period from April 2011 through June 2014 represents an exceptionally unfavorable environment for trend following with more than three years of negative performance. Although these losses appear minor compared to the preceding returns, in the case of the above strategy they amount to almost $80 per barrel of Brent crude oil, or $80,000 per contract – more than 150% of the strategy’s initial risk budget. Accordingly, an undiversified trend follower, if they jumped into oil trading in April of 2011 – even with the world’s finest trend following model – was liable to sustain a total loss.

The interval shown in the above chart was very profitable, but it included extremely challenging periods. This, unfortunately, is the inevitable aspect of uncertainty: we simply don't know when trends will take off or when and for how long they'll be absent, so we don't switch strategies on and off. The best we can say, from experience, is that markets trend about 1/3rd of the time and correct and consolidate about 2/3rds of the time.

The need for diversification

The only cure to the volatility of investment returns is diversification - fragmenting risk exposure across as many non correlated markets as possible. In that way, if we're experiencing a trendless period in one market, another one might be delivering the windfalls we're after. As the above example shows, even the generous $50/bbl risk budget would not have been sufficient to avoid a total loss during the phase D of the period, if you only traded crude oil.

In fact, that period was the ruin of many commodities funds, including one of the brightest shining stars of the 2008/9 period. BlueGold Capital Management, founded by Pierre Andurand, focused solely on trading energy derivatives and generated a net return of 209% in 2008, and another 55% in 2009. But from April 2011, as phase D got going, BlueGold lasted only about a year and shut down in 2012 with heavy losses.

Most of Andurand's investors sustained losses because they only jumped onboard once his 2008 returns had made him a star and his best performance was in the past. This is a common error in investing: at peak performance, assets look very attractive, with a slew of statistics confirming this. But the better approach is to try and understand what drives that asset’s performance and to make the allocation when the statistics look underwhelming.

Non correlated returns exactly when needed

Perhaps the best approach is to simply use trend following as a strategic diversifier. Most investors have the bulk of their investment risk allocated to traditional asset classes like stocks, bonds and real estate. In crisis periods, these can be highly correlated and experience significant corrections at the same time. Diversified trend following portfolios tend to have a strong inverse correlation to traditional asset classes at such time, as the following chart of Société Générale Trend Following index vs. classic 60/40 portfolio clearly illustrates:

The same principle emerged in our Major Markets portfolio which now has over five years’ continuity:

The above performance is not a mathematical simulation; it is based on the signals communicated through our newsletter over the years. As we can see from both of the above charts, equities have outperformed trend following since 2023, but that only makes the strategic diversification to trend following even more important: when (not if) equities correct or reverse into a bear market, the move in the opposite direction could turn out brutal. In the longer term, allocating risk to an uncorrelated investment strategy could prove to be the investor’s saving grace.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

Today’s trading signals

With yesterday’s closing prices we have the following changes for the Key Markets portfolio:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.