In yesterday's report I touched once more upon one of the recurring themes in these newsletters: patience. Patience is the essential prerequisite for success at almost any worthy endeavor in life, including investment speculation. Speculation entails making predictions about the future and investing our resources, whether financial or otherwise, to take advantage of the anticipated developments. Speculation entails uncertainty and risk, since our predictions might not be correct. Even if they are, we can never be certain about the timing of events as they unfold.

Consider the ongoing conflict in Ukraine as a historical event: most learned observers understood that Russia would prevail in that conflict. As President Obama appreciated already in 2014, Russia had the escalatory dominance and could not be defeated militarily. But it took more than three years of conflict for this to crystallize. Henry Kissinger predicted in 2012 that Israel would cease to exist in ten years' time, but whatever led him to that conclusion is only becoming discernible at the present time.

Large-scale price events

The point is that certain conditions lead to certain outcomes. For those who understand those conditions with clarity, the outcomes may seem predictable, but exactly how the events might unfold and over what time interval, is not. Financial markets give us a way to observe historical events and their effects, manifested in asset price fluctuations.

Markets have their own way to react to changing conditions, but they do so along a time scale that's hard for us to predict. They often move like inert, unpredictable blobs. This is because they consist of millions of individuals, each of whom process information in a different way and take action in different ways and at different times. Some are day traders, some very long-term value investors and others who fall somewhere in between. How their collective action may impact the markets is impossible to predict.

This can be a source of frustration to the individual investors; as individuals, we act in accordance with our own judgment and convictions, and we tend to expect that changes should begin to unfold about as soon as we become aware of them. But just because we reached some conclusion about what should happen does not mean that the markets will move as we expect they should. Even if our convictions are correct, the markets might take a long time until they come to agree with us.

Edwards and Grice’s Nikkei prediction

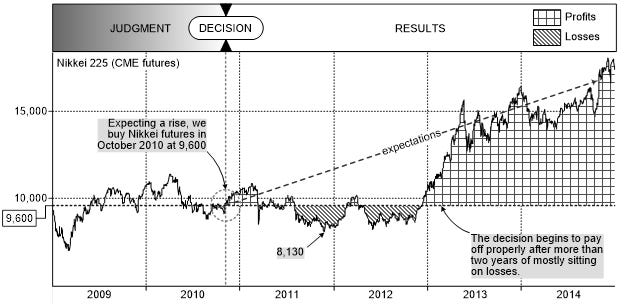

The example which illustrates this quite well and which I highlighted in the past was the October 2010 analysis report on the Nikkei published by SocGen's Albert Edwards and Dylan Grice. At the time, the Nikkei was trading around the 9,600 level and Edwards and Grice suggested that this was a great value and an excellent buying opportunity. As it turned out, they were correct, but the changes they anticipated took a very long time. That's precisely why patience is essential.

It was only toward the end of 2012 that the conditions Edwards and Grice identified started to take effect. From that time, the Nikkei would rise to about 40,000 level, but that only happened in 2024, fully 14 years after they had made their prediction. This is yet another confirmation of our hypothesis that large-scale price events are by far the most powerful drivers of investment performance, and also that they always unfold as trends that can span years. In this case, gaining the full advantage of a correct prediction took 14 years! That clearly would have required a great deal of patience.

The risks and the rewards

But in addition to patience, successful speculation also requires a judicious management of risk. In the two long years that the conditions for the Nikkei bull run matured, the Nikkei hit a trough at 8,130. For investors who might have bought Nikkei futures at 9,600, this entailed sitting through a 1,470 points drawdown, corresponding to a $7,350 loss per contract. At the time, the initial margin for a single CME Nikkei contract was $1,760, so for anyone who would have ventured to follow SocGen's advice with less than $7,350 cash cushion per contract, would have been wiped out.

But this story is also an illustration of the rewards that are available to those who approach the challenge with the requisite strategy, discipline and patience: the potential windfall in that Nikkei trade was $152,000 per contract. If you went long at $9,600, weathered the 2-year drawdown and sailed along with the bull trend to 40,000 level, you gained 30,400 points, or $152,000 per Nikkei futures contract. That looks straightforward when presented in a snapshot of time, but it didn't happen overnight: it had its rough patches, and it may have been psychologically challenging, but sailing along with trends has its rewards and they can be very substantial.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 11 March 2025

With yesterday’s closing prices we have the following change:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.