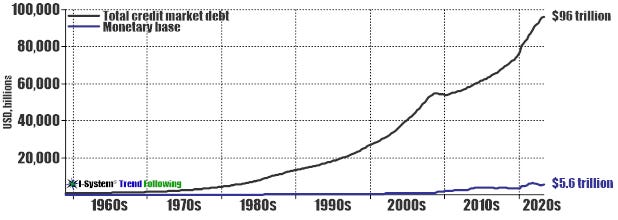

In spite of his strong public support and policies which, straight out of the gate, seem to satisfy the demands of a large segment of the American population, Donald Trump's presidency remains very vulnerable in the economic sphere. Here's the chart which I have shared here in October 2023 and which illustrates one of the lethal symptoms of the financial system under which modern economies throughout the world operate:

The total credit market debt represents the sum of all public and private debts in the US economy. The Fed renamed the series as, "All Sectors; Debt Securities and Loans; Liability, level" and since the time I shared this chart, it has grown from $96 trillion to $101,353 trillion. The monetary base, (cash in circulation + total bank balances) represents all the money that's available for repayment of those debts. That aggregate remains at $5.6 trillion. In other words, there's 18 times more debt in the system than there is money with which to pay it. This is, in fact, the definition of unsustainable and there's next to nothing Trump can do to alter this reality.

Sergey Glazyev, one of the world's leading monetary economists and close advisor to President Vladimir Putin gave his view of the situation via his Telegram channel. According to Glazyev's analysis of Trump's economic initiative, it seems that he is intending to base U.S. economic growth on a new technological order, but is being frustrated in this by the financial system controlled by the leading shareholders of the Federal Reserve System which is focused on generating superprofits by inflating financial bubbles. Trump's maneuvering space is limited due to a 4-fold increase in the USD monetary base over the last 15 years while industrial investment, economic output and living standards in the U.S. all stagnated.

With the costs of servicing US dollar debts surging and the resource base of the US financial system shrinking due to the fact that many countries are moving away from using the dollar as trade settlement currency and reserve currency, the American financial system itself is becoming increasingly vulnerable and unstable. As Glazyev sees it, Trump is trying to develop an alternative financial system based on cryptocurrencies outside of the traditional banking system.

Ushering a Milton Friedman utopia?

By completely liberalizing their creation and circulation, Trump is moving in the direction of the Milton Friedman utopia of free markets for private money in which any issuer of cryptocurrencies can compete. Perhaps he is inspired by the successful launch of his own cryptocurrency and may want to position himself as the largest issuer of such private money. All this could be fatal for the dollar-based financial system. In addition to losing foreign demand, the dollar's domestic demand could shrink substantially as it gets gradually displaced by privately issued cryptocurrencies.

The danger in this, as Glazyev says, is that this change will inevitably undermine the financial foundations of the American state: in spite of the fact that the dollar is issued by a private organization, the process is regulated by law and 95% of dollars in circulation are issued for the purchase of US treasury bonds in order to finance the public sector. At the same time, by depriving the Federal Reserve of a digital money monopoly, Trump will restrict the dollar's circulation in an alternative distributed ledger system. As a result, the US banking system could be submerged under a sea of privately issued cryptocurrencies. That will only exacerbate inflation and the collapse of the 'everything bubble.'

A strategy of (un)controlled chaos?

But Glazyev doesn't see much evidence of a systemic approach in changes being pushed forward by Trump. Driving a new technological order will require his administration to master strategic planning and targeted lending for investments in the expansion of its productive capacities. At the same time, by stimulating the creation of private cryptocurrencies they could undermine the existing mechanisms for allocating credit without creating viable alternative mechanisms. Glazyev concludes that the American century-long systemic cycle of capital accumulation could be coming to an end, pulling the imperial world economic order down along with it.

Of course, Glazyev's analysis could be mistaken. Even if it is valid in principle (I believe that it is), Trump could, and probably will, change course and pull away from radical free monetary markets direction once its potential consequences become apparent. In a different sense, the thing that Glazyev's analysis makes apparent is the difference of approach between Russian leadership and its western counterparts. In Russia (and the same is true about China), the leadership is very reluctant to undermine the existing foundations of society even when it's glaringly obvious that they require a thorough overhaul. Instead, they tend to take time to thoroughly study the needed changes and analyze their potential repercussions, moving gradually, then changing course as needed.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page.

Trading signals for Key Markets, 27 Jan. 2025

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.