The bumpy ride in the markets has resumed after Easter weekend and investors are understandably concerned that we could be on the precipice of another 2008 crisis, or perhaps something even worse. This is understandable as headwinds gather for the US economy in a real way. Bankruptcies have risen sharply: in Q1 2025, 188 large corporations filed for bankruptcy, which is 49 more than in Q1 2024, the highest figure in 14 years. Consumer confidence has cratered and one-year inflation expectations spiked +1.7% in April to 6.7% - the highest level since November 1981!

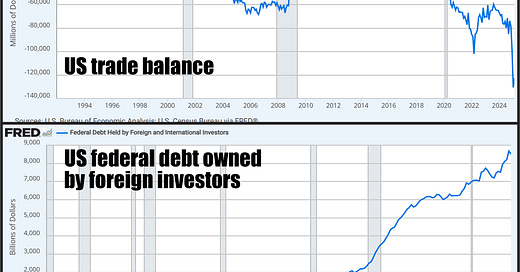

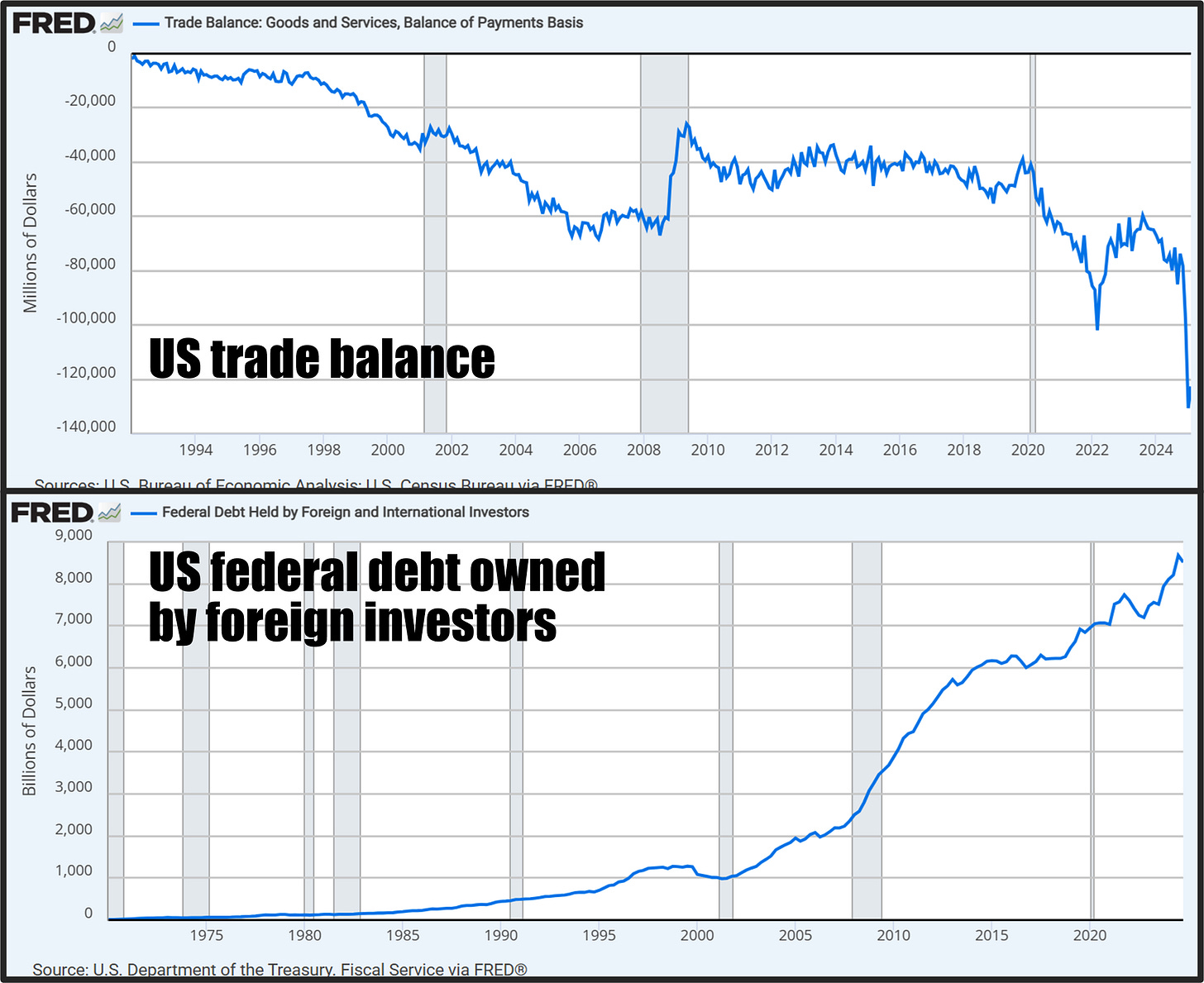

Of course, everyone is blaming President Trump and his tariff shock, which is also understandable - it is what triggered the growing panic. However Trump didn't create the current imbalances in the economy. He did contribute to them in his first term, but they have been metastasizing pretty much since Richard Nixon ended the dollar's convertibility into Gold in 1971. From that time on, the US went from having a positive balance of trade with foreign countries to a chronic and widening trade deficit. Foreign exporters to the US earned more and more US dollars, much of which were recycled into US investments including equities and government bonds. The following two charts from Federal Reserve illustrates these trends:

The United States was becoming the world's largest consumer of foreign goods, in effect running a tab with many exporting countries around the world. That created a huge glut of foreign held IOUs. This was never sustainable and it was guaranteed to blow up at some point, sooner or later. The Trump administration's tariff gambit is an attempt to reverse these imbalances by reducing imports, reducing the glut of foreign-owned dollar assets, and creating favorable conditions for reindustrialization of the US, rather than waiting for the dam to burst at some future point.

Clearly, these measures will cause economic withdrawal symptoms for the US economy and global financial markets, long addicted to the system created in the early 1970s under the Nixon administration, led by Henry Kissinger and Paul Volcker and perpetuated by every administration and every Fed chairman since then. Time will tell whether these measures will prove successful, or whether the therapy ends up killing the patient.

Did Biden leave landmines for Trump?

We should note that Trump inherited a very unhealthy economy, and the outgoing Autopen administration may have deliberately made things much worse so that they could blow up on Trump's watch. Notice the sharp drop in US balance of trade in the above exhibit: in November 2024, when Trump won the elections, US trade deficit was $78.2 billion, but then it exploded to $98 billion in December '24 and further to an all time high of $130.65 billion in January by the time of Trump’s inauguration.

The spike is completely unprecedented: it's almost like someone deliberately left economic landmines for the incoming administration. Of course, we need not suspect foul play: as we well know, things always just happen randomly, perhaps due to a bit of incompetence, honest mistakes, climate change, Vladimir Putin, China, China, China, etc. There will be lessons learned, and then the last remaining blemishes will be removed from our wonderful, democratical systems of governance. Until then, we can all agree that everything bad will be Trump's fault.

LSPEs could bring windfalls for trend followers

For our purposes, in spite of the volatility, the conditions will generate, and are already creating many large-scale price events (LSPEs) which will - as they always do - unfold as trends, generating windfalls for the disciplined and patient trend followers.

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

Today’s trading signals

With yesterday’s closing prices we have the following changes for the Key Markets portfolio:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.