One of the looming risks that could materialize on the back of the wars raging in the Middle East and in Ukraine is the risk of a sharp increase in inflation rates, which could happen suddenly and without warning. This tends to have devastating effects on people’s wealth and purchasing power. The inflationary cycle could last a considerable time and once it begins to accelerate it is extremely difficult to control. Even with moderate levels of inflation, the impact on people’s wealth can be severe.

As a reminder, through the decade of the 1970s inflation averaged at 9%, but investors on average lost 65% of their wealth in real terms (based on the performance of a typical 60/40 stocks/bonds allocation). Today we can't rule out the possibility that the next inflation cycle could be worse than it was in the 1970s.

Commodities: your best hedge against inflation

Facing these risks, exposure to commodity prices represents the best possible hedge against inflation, and we are not only talking about silver and gold. Prices of energy, industrial metals and agricultural commodities could all soar, offering windfall opportunities for traders and investors capable of navigating these trends. In fact, gaining exposure to commodity prices is the most effective way of offsetting the negative impact of inflation.

The most effective ways of gaining such exposure is through commodity futures contracts, CFDs (contract for differences), or through appropriate ETFs (exchange-traded funds). There’s much empirical evidence supporting the claim that exposure to commodity prices is the best hedge against inflation.

For example, an Alliance Bernstein analysis[1] found that of all asset classes, commodity futures had the highest inflation beta:

Another report focused on 20 financial accidents[2] over a 32-year period and found that “Managed futures delivered a positive return in 18 out of 20 accidents in the equity market. In the field of investment management, there is simply nothing that comes anywhere close to this.” [3] In this case, “managed futures” refers to investment funds that provide exposure to commodity futures markets to investors.

Gary Gorton and K. Geert Rouwenhorst analysed seven boom-bust cycles (1959 – 2004) and found that managed futures generated positive real performance both during recessions and periods of high inflation. [4] Twomey et al. concluded that, “Managed futures outperform the other asset classes… No other asset class presents itself as a viable inflation hedge [5]

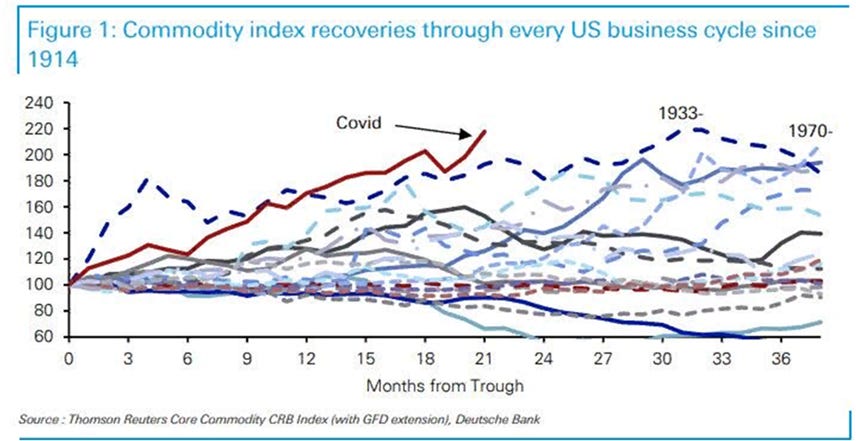

Our most recent inflation episode, in 2021/22 which happened on the back of Covid 19 pandemic, confirmed all these findings, only it did so in a stronger than average way: it eclipsed all of the previous 20 cycles since 1914 as the strongest rise in commodity prices on record. A research report by Deutsche Bank's Jim Reid produced the following chart to illustrate the point:

Observing the current trends in commodity prices, it seems like we could be at the beginning of another commodity bull cycle: crude oil, natural gas and metals are all either strongly in an uptrend, or have gradually started to build one up. As Jim Reid’s chart above shows, in cycles that involved commodity price bull markets, these trends seem to have persisted for a considerable time, so what we’ve seen in price movements on gold, crude oil, silver, platinum and copper could only be the beginning with much more to come up ahead.

Notes:

[1] Alliance Bernstein: “Deflating Inflation: Redefining the Inflation-Resistant Portfolio.” – April 2010

[2] Market accidents: incidences where MSCI World Index lost 7% or more within one, two, three, or four months

[3] Ineichen Research and Management report (June 2012)

[4] Gary Gorton & K. Geert Rouwenhorst. Facts and Fantasies about Commodity Futures, NBER Working Papers 10595, National Bureau of Economic Research, Inc., 2004.

[5] Twomey et al. “Assessing Managed Futures as an Inflation Hedge within a Multi-Asset Framework” – The Journal of Wealth Management, Winter 2011. < https://jwm.pm-research.com/content/14/3/33>

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

Today’s trading signals

With yesterday’s closing prices we have the following changes for the Key Markets portfolio:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.