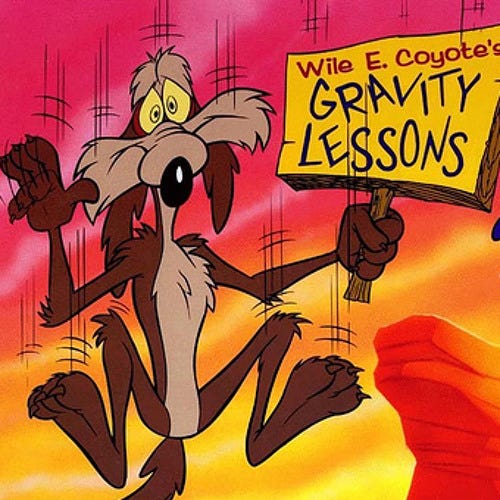

Global markets could be in the Wile Coyote moment when all the causes of a future crisis are already present, but the markets aren’t yet reacting.

Yesterday, I had the pleasure of sitting down again for a chat with the founder of Armstrong Economics, Mr. Martin Armstrong for a 45-min. chat about the circumstances in the world and how they are impacting markets.

Armstrong’s prediction is that the world slips into a stagflation through 2028, which could be exacerbated by global political instability. Germany could turn out to be the weak link due to her negative economic growth. Among other things, Germany’s poor economic performance is creating political pressures toward war escalations. While I generally agree with that prediction (and have predicted essentially the same unravelling over the years), I can’t make up my mind whether the weakest of the weak links is Germany or Japan or the UK. And if it’s Germany, it pretty much means the EU collapses altogether.

Cornering Putin into WW3?

Our discussion turned to geopolitics which is one of the main drivers of fluctuations in the financial markets. Armstrong sees the risk of World War 3 easily breaking out because the recent Ukraine/CIA/MI6 attacks on Russia are pushing Vladimir Putin into a corner: he will have to retaliate or be overthrown. To be sure, there are political pressures on Putin to take off the kid gloves and wrap up the Ukraine, but I am not convinced that Putin will succumb to those pressures.

I believe that retaliating against Western targets and giving Western powers the pretext to escalate the conflict to World War 3 would be a Christmas present for Russia’s enemies in the West and would almost certainly trigger a global conflict. But this is exactly why Putin is unlikely to give his enemies that gift. The greatest revenge Russia could inflict on the West is to simply win in Ukraine and impose their terms of peace. Far too much is at stake for Vladimir Putin to permit himself an error of impulsive reactions that could unbalance Russia’s position and jeopardize her strategic objectives. A retaliation will happen, but it will be asymmetric and won’t likely change the trajectory of Russia’s military operation.

CBDCs: most likely to fail

Our conversation also touched upon the CBDCs which the EU is rushing to roll out. I believe that the currency will fail to meet its objectives, but it will help achieve one objective: ultimate imposition of capital controls by the ECB, as Martin Armstrong hypothesized. He believes that capital controls will be introduced as soon as Europe becomes involved in any hostilities, be it against Russia or against its own disobedient populations.

You can find the full conversation at Triangle Investor podcast:

To learn more about TrendCompass reports please check our main TrendCompass web page. We encourage you to also have a read through our TrendCompass User Manual page. For U.S. investors: an investable, fully managed portfolio based on I-System TrendFollowing is available from our partner advisory (more about it here).

Today’s trading signals

With yesterday’s closing prices we have the following changes for the Key Markets portfolio:

Keep reading with a 7-day free trial

Subscribe to I-System TrendCompass to keep reading this post and get 7 days of free access to the full post archives.